Correctly setting up fees and taxes in mr.alfred is essential to ensure your booking breakdown matches what appears on OTAs like Airbnb and Booking.com. Misconfigurations here can lead to discrepancies in guest pricing and payout calculations.

This guide will show you how to:

- Create, rename, and apply fee and tax rules

- Set calculation methods

- Assign OTA channels and payment logic

- Prevent common mistakes that impact bookings

🔗 Related: How to Add and Configure a Property

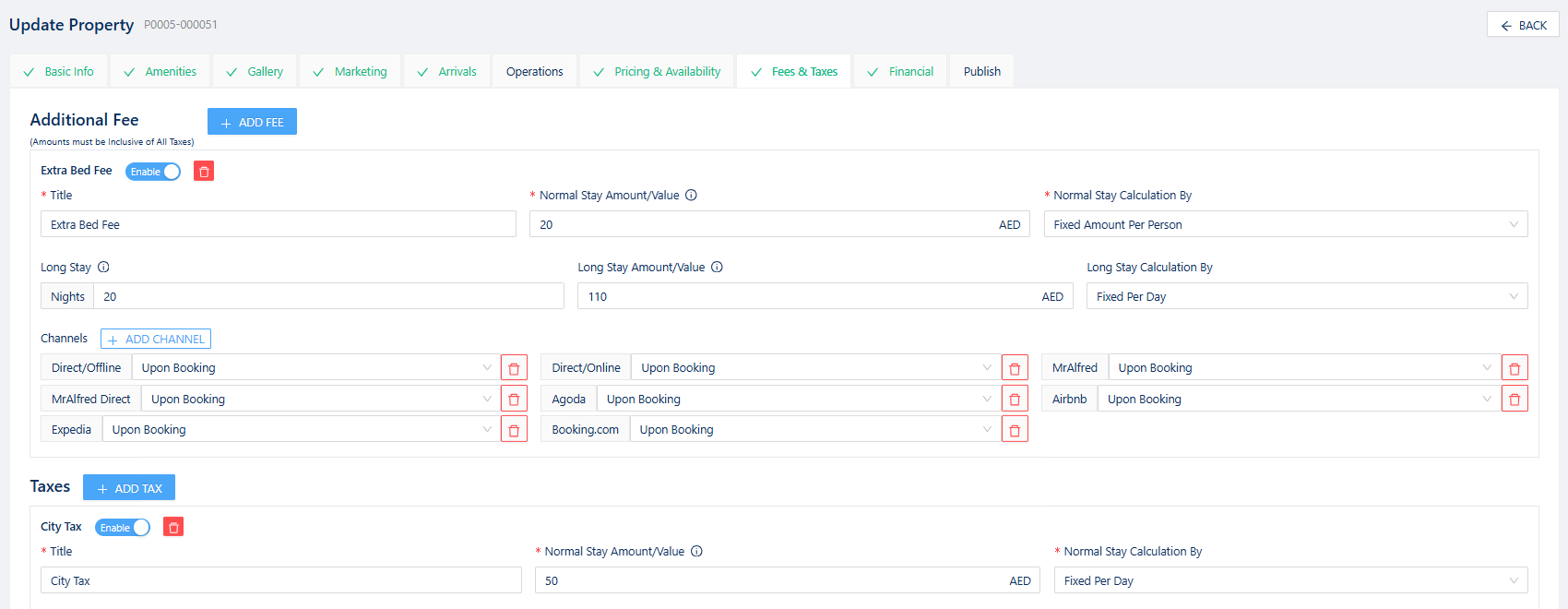

📚 Where to Configure Fees & Taxes

Fees and taxes are configured at the property level only.

- Go to:

Properties module → Properties submodule - Select a property

- Open the Fees & Taxes tab

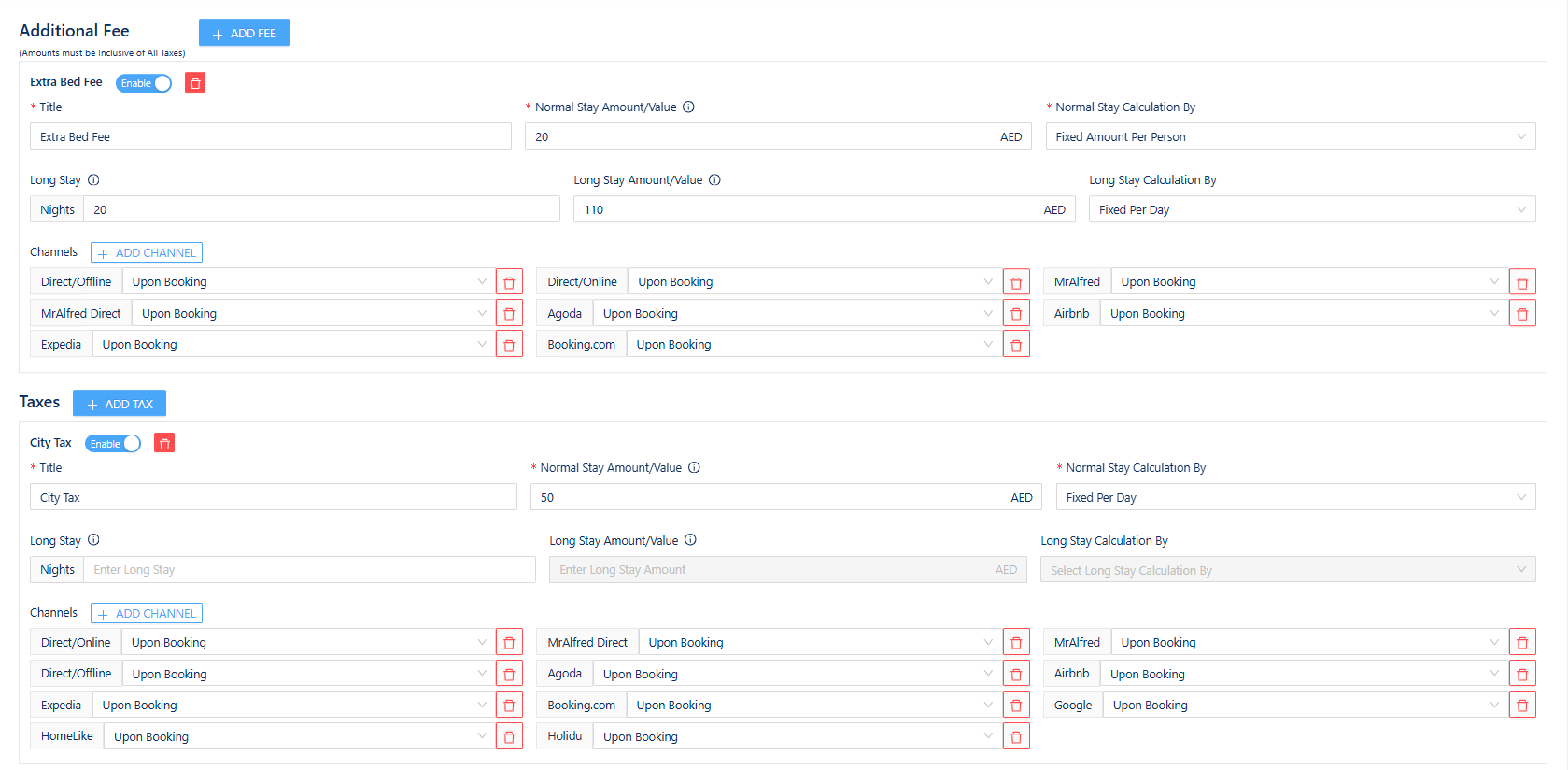

🔢 Step 1: Add or Modify a Fee or Tax

- Click Add Fee or Add Tax

- Choose from the predefined list of types (or create a custom one)

- You can rename the fee or tax to match local requirements

💡 Tip: Ensure your fee/tax names match exactly what’s configured in your OTA dashboard.

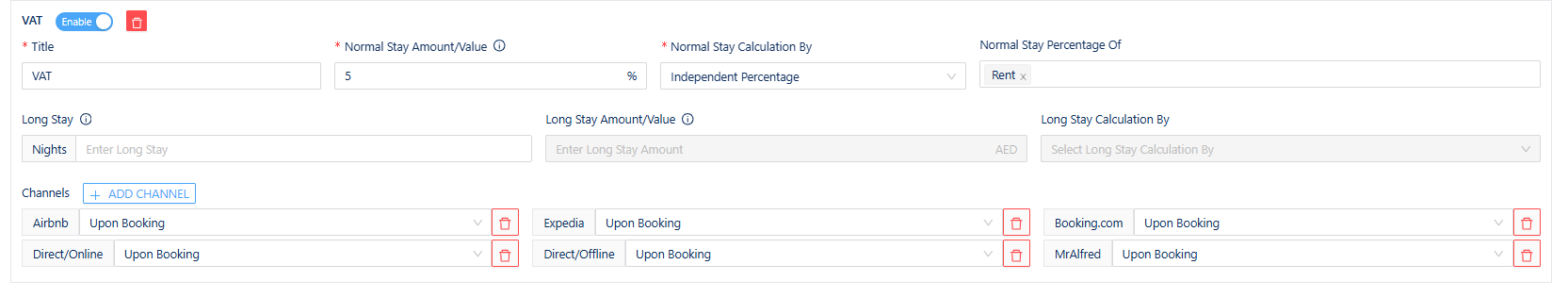

🧮 Step 2: Set the Calculation Method

For each fee or tax, you can configure:

- Amount/Value

- Calculation Type:

- Per stay

- Fixed per day

- Fixed per person

- Fixed per person per day

- Independent percentage

If using Independent Percentage:

- For fees, the base is always the room night

- For taxes, the base is also room night

- You may add fees to the taxable base if required by your local regulation or OTA setup

⚠️ Common mistake: Many users apply tax only to room night, while their OTA applies it to both room night + fees — always verify this.

⏱ Step 3: Enable Long Stay Logic (Optional)

You can define an alternate fee/tax logic for long stays:

- Enter number of nights that count as a long stay

- Specify different amount/value and how it is calculated

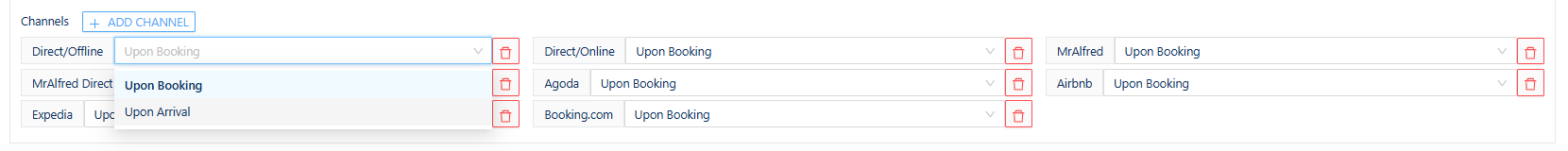

🌐 Step 4: Assign OTA Channels & Payment Timing

Select:

- Which OTAs the fee/tax applies to (e.g., Airbnb, B.com)

- Payment method:

- Upon booking (OTA collects)

- Upon arrival (guest pays at check-in)

⚠️ Fees marked as “upon arrival” are not collected by OTAs and must be paid directly by the guest.

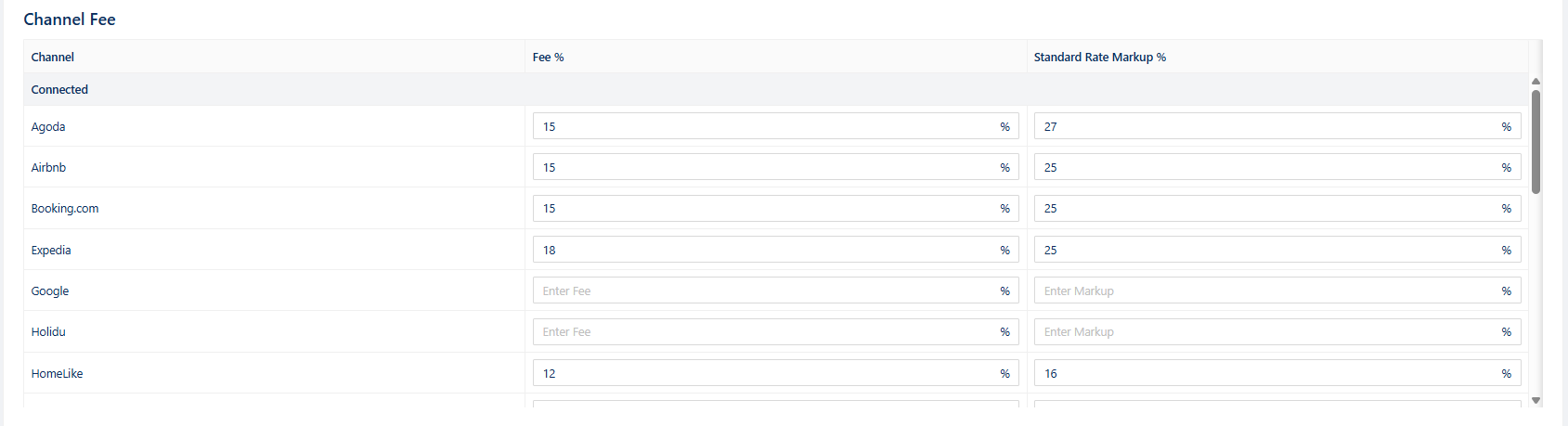

💼 Step 5: Set Channel Commission Percentage

Also in the Fees & Taxes tab, you must enter the channel commission percentage for each OTA. This ensures:

- Correct net payout calculations

- Proper breakdowns in booking reports

- Compatibility with automated financial formulas

💡 Example: Airbnb takes 15% commission → Add “Airbnb Channel Fee: 15%”

⚠️ Common Mistakes to Avoid

- Mismatch between OTA and PMS setup: Always double-check your OTA tax/fee structure

- Forgetting to add an OTA under the fee/tax: Even if it exists, it won’t apply without an assigned channel

- Not including fees in tax base (when required): Results in booking discrepancies

- Missing or inconsistent tax rules: Causes errors in guest pricing and owner payouts

- Not reviewing end-of-month totals: Validate booking breakdowns before host invoicing

🔁 Best practice: Schedule a monthly fee/tax audit for each OTA and property

🔗 Need Help?

- 🎓 mr.alfred OS training & tutorials

- ❓ Contact your CS rep if you’re unsure how to match OTA configurations